![]()

Urgent message: Using a data-driven approach to predict performance, taking advantage of openings in traditional retail spaces, or utilizing resources like BTS to develop a standalone center greatly improves a growing urgent care chain’s potential profitability and long-term brand success.

Alan Ayers, MBA, MAcc is President of Experity Networks and is Senior Editor, Practice Management of The Journal of Urgent Care Medicine.

A “stagnant business” is a “dead business” (or, in the words of former Notre Dame football coach Lou Holtz, “If you’re not growing, you’re dying)”. This is especially true for urgent care operators.

With constant innovation and new competition vying for patients, growth is essential for operators that want to increase the value of their existing business. In a brick-and-mortar business like urgent care, revenue growth can be realized by adding services to existing facilities. However, long-term growth in “valuation” (ie, what a buyer would pay for the business) occurs by adding new locations.

But what should location growth look like in 2022?

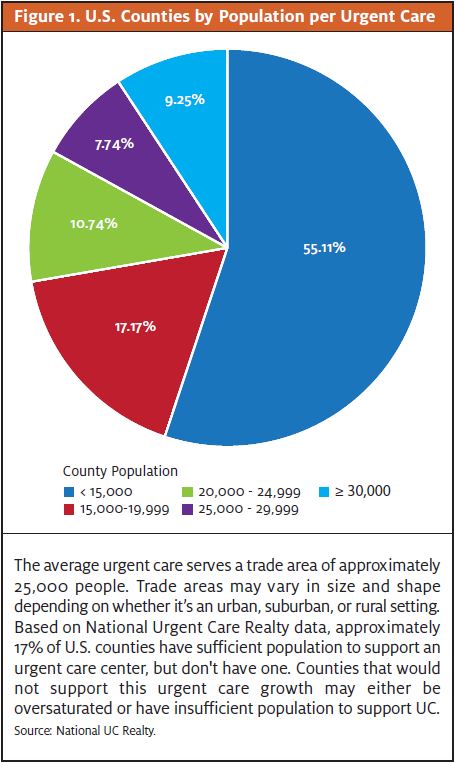

As COVID-19 becomes endemic, urgent care operations are returning to a sense of normalcy. The pandemic lifted the “floor” in urgent care visits by adding a new, year-round respiratory condition as well as heightened awareness through increased use during the pandemic. But this “normalcy” doesn’t mean the demand for new centers has vanished. Per data from National UC Realty (Figure 1), approximately 17% of U.S. counties are still under-represented in urgent care, on a population basis.

Let’s look at some key points to consider while searching for the ideal location of your next urgent care center.

Site Selection Is Key

With any retail site selection, analytics and real estate need to work in tandem. Once you have a targeted trade area in mind, you can start analyzing different locations, factoring in whether leasing or building a physical location makes the most economical sense.

Today’s macroeconomic conditions, combined with the effects of high volatility in retail, make leasing retail space and building new locations very appealing options for operators. In the case of leasing, urgent care operators not only have more available space to choose from, but thanks to the pandemic are highly sought-after tenants for property owners.

This hasn’t always been the case. In fact, the often-strained relationship between landlords and urgent care operators has been a challenge over the past 15 years. Many landlords denied tenancy based on preconceived notions that urgent care centers wouldn’t drive traffic to adjacent businesses or would pose dangers with medical waste and x-ray radiation.

Fortunately, attitudes are changing. A recent report from The New York Times suggests that many landlords are actively courting doctors and dentists to fill their empty spaces.1 Especially since landlords saw the “resiliency” of urgent care compared to consumer discretionary businesses like gyms and bars that were shut down during the pandemic.

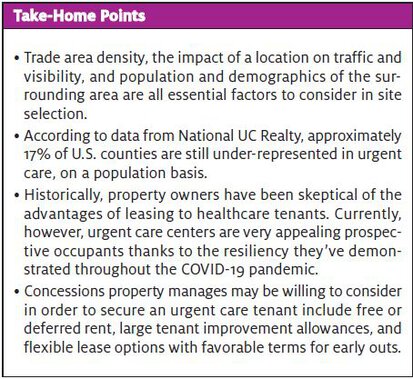

With plenty of options out there, it’s wise to be picky when selecting a location for your next urgent care center. Many operators choose to work with a company that specializes in urgent care predictive performance analytics. Regardless, a data-driven approach is essential. Consider factors like trade area density, the impact of the physical location on traffic and visibility, as well as the population and demographics of the surrounding area.

When conducting site visits, you should also seek answers to the following questions:

- What are my signage options and how visible can signs be?

- Is the building difficult to get to?

- Is the building highly visible?

- Are there parking limitations?

- Are there medical use exceptions?

- What are the ongoing maintenance costs?

- Is there good car and foot traffic during key times/days?

- Are there any accessibility issues for injured patients?

- Who are my adjacencies and how much foot traffic are they bringing?

- Is there any risk of poor-quality co-tenants in the future?

Use Market Changes to Your Favor

With real-estate investors eager to lease to growing, recession-proof, and pandemic-reliant businesses, urgent care is in a good spot. Operators can look to take advantage of this by negotiating favorable leases in existing spaces.

Property managers are often willing to offer concessions such as free or deferred rent, large tenant improvement allowances, and flexible lease terms with favorable terms for early outs.

One urgent care operator, who grew his practice from 17 locations in 2019 to nearly 30 in 2022, says he negotiates a lease every time he finds a great retail space—doing so for very specific reasons. By negotiating free rent with landlords, he can afford to sit on a new space for 6 to 12 months until market conditions and patient volumes at the new center are ready to take off.

Tenant improvement allowances, in which the landlord pays for the interior construction of the urgent care space, let him open these new locations using minimal capital and with little risk. If his new center fails to meet its objectives, he’s able to terminate his lease early with minimal penalties. This helps reduce the overall risk of opening new locations—a major concern for many urgent care operators.

The ‘Amazon Effect’

In some ways, current retail trends point back to the industry’s broader evolution over the past decade, albeit accelerated by the global pandemic. Even before COVID-19, the Amazon effect on the commerce industry forced business leaders to re-evaluate how their companies can best meet changing consumer expectations.

Over the past few years, more retailers have continued to downsize and close expensive brick-and-mortar locations as they shift focus to their online marketplaces and frictionless digital experiences.

CVS Health is one such retailer, recently announcing its new consumer-minded strategy amid plans to shutter 900 locations (approximately 10%) across the United States, beginning this year.

At face value, this increasing vacancy and retail availability might seem overwhelmingly positive. However, there are some things to be cautious about.

Businesses formerly occupying these locations have strong brand recognition throughout the community. When you move an urgent care center into one of these spaces, you’ll have an uphill battle to overcome any existing bias toward the previous tenet while establishing your own brand. Meaning—if a building architecturally looks like a First National Bank branch—everyone will continue to think “that’s where the bank closed” and there can be major headaches in completely refashioning an existing building.

Existing building configurations can present additional challenges since the location and design of your center directly impact patient volume. If people don’t recognize your center, have trouble finding it, or have limited space for parking, they likely won’t come back for future care.

| “While the ‘Amazon effect’ of internet shopping has led to vacancies in mall-based and big box retail, grocery-anchored centers still continue to attract weekly shoppers with adjacencies that include banks, car washes, hardware stores, dollar stores, quick serve restaurants, and other “on-demand” services that are not efficient for online delivery.” |

Merger Woes

At face value, choosing to acquire or merge with an existing urgent care center may seem easier than starting a new clinic from scratch–despite the wealth of locations available. However, this typically isn’t the case. Mergers and acquisitions often consume far more time and money than operators assume.

This is partially due to the pandemic making valuations far more difficult. Traditionally, a business is purchased based on its earnings in the previous year. However, urgent care has experienced extreme, sometimes volatile, performance throughout the pandemic.

Provider and staff turnover presents another risk. As does the need to make additional investments and upgrades to your facility. Upon taking over a new center, you’ll likely need to implement new systems, workflows, policies, and procedures. You may also need to invest more capital into upgrading the physical features of your building or remodeling them to fit your business’s needs.

In other words, an acquisition takes not only all your money but your time as well. For small- to medium-sized operators, opening a new location is often easier and cheaper than acquiring someone else’s center.

Starting from scratch lets you get up and running more quickly and to start seeing a positive cash flow on your books.

Bottom line? For the cost of acquiring an urgent care center for $1 million—which requires additional investment—you could use the same capital to build two, or even three, new centers.

The Benefits of Standalone Centers

While it’s clear that starting from scratch is the best course of action, you still need to be careful when selecting a location for your urgent care. With the abundance of former retail space available, you have many options to consider.

One of the biggest decisions is choosing between a location integrated with a shopping center or plaza vs a standalone building.

Freestanding buildings are key to business longevity. Ten to 15 years ago, you could put an urgent care center practically anywhere and attract patients. That’s no longer the case. Across the board, we’re seeing more established urgent care players lose market share to competitors opening branded standalone facilities.

A significant portion of today’s urgent care centers remain in multitenant buildings. It’s only a matter of time before these centers are outpositioned by those in standalone buildings.

Operators who have transitioned their real estate model from in-line spaces to standalone buildings found the latter enhanced brand awareness and consumer perceptions of quality, as well as uplifting overall patient satisfaction. Branded urgent care facilities also offer patients more visible locations with easier access and dedicated parking lots.

Mike Zelnik, president and founder of National UC Realty, estimates that freestanding buildings are worth between eight to 10 additional patients per day. That adds up quickly and translates to found money for owners. It also points to higher, long-term profitability.

| “Now is the best time to create a better, more visible product than your competitors. This occurs through a stand-alone building. If you sit back and don’t move now, someone else will come in, establish their brand, and then you’ll end up marketing for them instead.” —Michael Zelnik, president and founder, National UC Realty |

Build-to-Suit Development is Booming

Well-run urgent care centers are sitting on a tremendous opportunity to expand their business. But, as an operator, it also pulls you away from your core mission of operating an urgent care business.

You need to not only determine the best locations to expand into, but also find a developer to build the physical buildings and determine how to finance the costs.

Here, small-to-midsized operators can explore cost-effective, hassle-free options such as build-to-suit (BTS) development programs or franchise models to bypass the amount of time, complexity, and upfront capital typically required for building standalone facilities.

A BTS agreement is when a commercial property tenant partners with a developer to build a custom facility they will then occupy and lease.

Smaller urgent care operators have historically been unable to work with BTS contractors due to financial constraints. Fortunately, that’s no longer the case. There are integrated developers that combine site analytics, financing, and construction enabling an urgent care operator to build multiple turnkey centers without upfront capital.

Alan Lagunov, principle in UrgentCareDevelopment.com says, “Our site selection methodology utilizes propriety data and analytics to find operators the best markets, the best locations within those markets, and build and finance a custom-designed facility they can drop their operations into and hit the ground running.”

Rather than coming up with half a million dollars to build everything from the front desk to the exam rooms for just one center, UCD builds turnkey buildings with all costs and expenses financed into their leases. This not only decreases the required upfront capital but also saves you time that can be redirected back to operating your businesses.

Conclusion

Whether you’re opening your fifth urgent care center or your 50th, choosing an ideal location is crucial. By using a data-driven approach to performance prediction, taking advantage of openings in traditional retail spaces, or utilizing resources like BTS to develop a standalone center, you’ll greatly improve your profitability and long-term brand success.

References

- Margolies J. To fill empty retail space, landlords tap doctors and dentists. The New York Times. Available at: https://www.nytimes.com/2022/02/22/business/real-estate-retail-space.html. Accessed July 26, 2022.

480-245-6400

480-245-6400